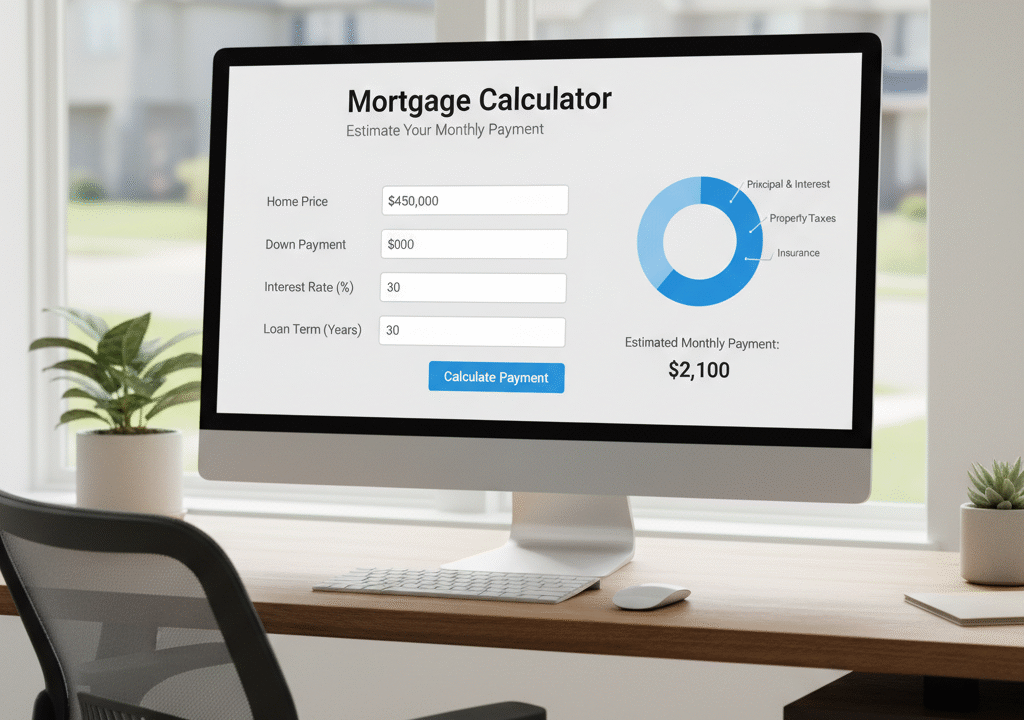

🏠 Mortgage Calculator

Calculate your monthly mortgage payments and total costs

Mortgage Calculation Results

Monthly Payment Breakdown

Intro

Buying a house is a huge money choice. Knowing what your monthly payment might look like is a key first step. A mortgage calculator is super useful because it gives you that info right away. It helps you figure out what you can realistically afford and plan your budget before you even talk to a bank. Our free online calculator makes these tricky numbers easier, giving you the info you need.

What’s a Mortgage Calculator?

Think of it as a tool that guesses what your monthly mortgage payment will be. You put in some loan details, and it figures out the main payment and the interest. Good calculators also add in property taxes, homeowner’s insurance, and PMI (if needed). This gives you a full idea of what your house will really cost each month, so there are no surprises.

Why Use One?

If you don’t know what you’ll be paying, you might fall for a house you can’t actually afford. A mortgage calculator helps you be realistic and set a budget for your house search. You can look at different loan options and rates side by side. This makes you smarter when you talk to real estate agents and banks. It’s really the first step in buying a home responsibly and handling your finances well.

What to Put In for the Best Guess

To get a good estimate, you need to give the calculator some real numbers. Each thing you enter helps figure out that final monthly payment.

Home Price and Down Payment

The home price is how much the property costs. Your down payment is the money you pay upfront. A bigger down payment lowers your loan amount and can skip PMI. This helps reduce your monthly payments and the total interest you’ll pay.

Loan Length and Rate

The loan length is how long you have to pay back the loan, like 15 or 30 years. The rate is what it costs to borrow the money, shown as a percentage. A longer loan means smaller payments each month, but you pay more interest in the long run. A lower rate can really lower your monthly payments.

Property Taxes and Insurance

Property taxes are yearly taxes from your local area based on your home’s value. Homeowner’s insurance protects your place from damage, and banks usually require it. Our calculator can add these in so you see the real cost of living in the house each month. This is PITI (Principal, Interest, Taxes, Insurance).

Understanding Your Payment Plan

An amortization schedule is just a table showing how each payment is broken down over your loan’s life. At the start, most of your payment goes toward interest. Later on, more of it pays off the actual loan amount. This helps you see how much your mortgage will cost long-term and how making extra payments can help.